Introduction

CORE is an “open-access platform” “for a changing world” and “for anyone who wants to understand the economics of innovation, inequality, environmental sustainability, and more”.1 It attempts to readjust economics teaching towards taking the financial crisis into account. As of December 2017, its textbook – The Economy – is used to teach undergraduate economics at 64 universities, e.g. in the UK at Bangor Business School, Birkbeck (University of London), Cardiff Business School, Kings’ College London, London Metropolitan University, Northampton University, University College London, University of Aberdeen, University of Bath, University of Bristol, University of Manchester and University of Plymouth.2 CORE has received praise from the New Statesman, the Guardian and the Financial Times to name but a few.

In these notes, we critique the first unit of this course, henceforth simply referred to as Unit 1.3 In particular, we want to show that the primary purpose of this unit is to convince the reader that capitalism is rather good by a sleight of hand: GDP per capita is posited as the standard for how people are doing in a society, and across different societies. Potential social-democratic objections to the celebration of capitalism’s success are addressed by mentioning them. They are thus appreciated but then demoted to policy concerns. This seeks to deliver on the promise that economics teaching in “a changing world” must take into account that capitalism and its academic treatment have an image problem after a decade perceived as a permanent crisis, especially amongst the target demographic:

“One important legacy the financial crisis has left us with is a new generation which is no longer satisfied with learning the economics which got this so wrong. No young person who has witnessed or participated in the #Occupy protests around the world – such as the one taking place in Hong Kong now – can remain wedded to a curriculum which fails to evolve in their wake.”

Wendy Carlin, 2014, Building a new economics for the #Occupy generation

The hockey stick

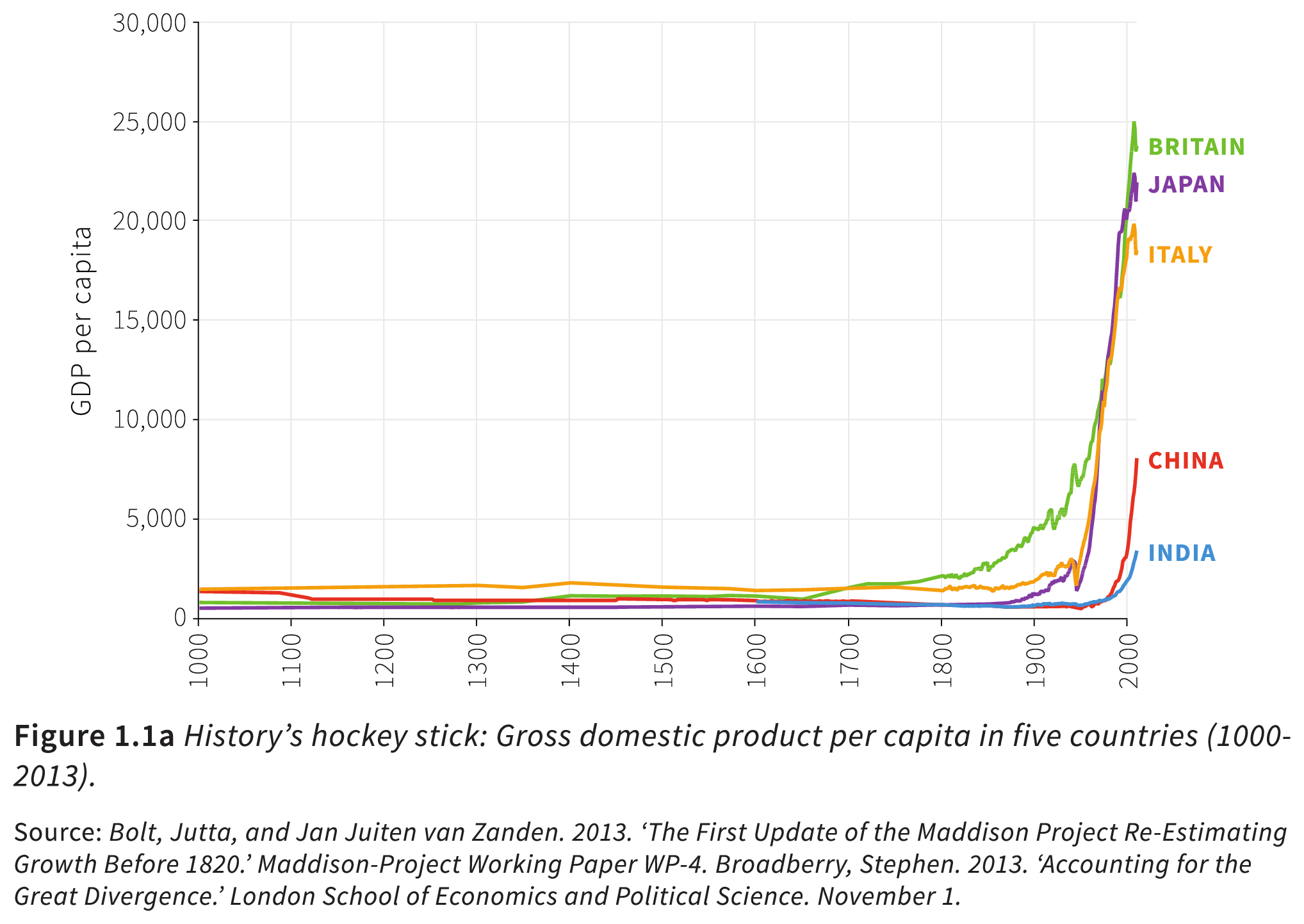

CORE starts its exploration of the capitalist mode of production with a look-see at pre-capitalist times as a preparation for the “hockey stick” given in Figure 1.1a. It shows flat curves for several countries from the year 1000 to 1700 and a very sharp upward movement from 1700 or later depending on the country.4

As far as CORE is concerned, this curve plots the living standard or, synonymously, wellbeing in each country over time for various countries. That is, CORE seeks to express a unified and quantifiable living standard in any given society. CORE explains:

“To compare living standards in each country, we use a measure called GDP per capita. People obtain their incomes by producing and selling goods and services.5 GDP (gross domestic product) is the total value of everything produced in a given period such as a year, so GDP per capita corresponds here to average annual income. GDP is also referred to as gross domestic income. In Figure 1.1a the height of each line is an estimate of average income at the date on the horizontal axis.”

The Economy, Unit 1, Introduction

Thus, Figure 1.1a expresses living standard or wellbeing as the sum of what a society produces divided by the number of people in that society. As far as this metric is concerned, this much is clear already on the first pages of this economics textbook, and before we learned a single thing about how this mode of production actually works: capitalism is rather good at producing wellbeing as such. The rest of Unit 1 is dedicated to creating the impression that this claim makes sense. These notes are dedicated to showing that this is wrong.

Distributions

Unit 1 immediately follows Figure 1.1a by addressing potential objections to it. The objection CORE in principle permits, but ultimately dismisses, is one of income distribution. That is, simply dividing the social product by the number of members in society, i.e. taking the average, is an arbitrary abstraction. In Figure 1.2 of Section 1.1 CORE illustrates distributions of household incomes in various countries over the last 50 years and then asks:

“Dividing by the population gives GDP per capita – the average income of people in a country. But is that the right way to measure their living standards, or wellbeing?”

The Economy, Section 1.2

CORE chooses to entertain the criticism of averages in the form of criticising another measure for wellbeing which it is not too keen on: disposable income.

“Consider a group in which each person initially has a disposable income of $5,000 a month, and imagine that, with no change in prices, income has risen for every individual in the group. Then we would say that average or typical wellbeing had risen.

But now think about a different comparison. In a second group, the monthly disposable income of half the people is $10,000. The other half has just $500 to spend every month. The average income in the second group ($5,250) is higher than in the first (which was $5,000 before incomes rose). But would we say that the second group’s wellbeing is greater than that of the first group, in which everyone has $5,000 a month? The additional income in the second group is unlikely to matter much to the rich people, but the poor half would think their poverty was a serious deprivation.”

The Economy, Section 1.2

In other words, CORE knows that taking averages does not express how people are doing since it extinguishes how something is actually distributed:

“Since income distribution affects wellbeing, and because the same average income may result from very different distributions of income between rich and poor within a group, average income may fail to reflect how well off a group of people is by comparison to some other group.”

The Economy, Section 1.2

Yet, taking the average of the output (GDP per capita) does not tell us any more about what wealth people have access to than taking the average of household incomes. In both measures, a society where (a) all produce goes to the king (save bare necessities for the rest) appears no different from a society where (b) all produce is distributed equally6 or (c) is made available to all members according to their needs and desires. Again, CORE knows and mentions this:

“The gaps between what we mean by wellbeing, and what GDP per capita measures, should make us cautious about the literal use of GDP per capita to measure how well off people are.”

The Economy, Section 1.2

This caveat is not meant to criticise measuring living standards by GDP per capita as in Figure 1.1a. Unit 1 continues:

“But when the changes over time or differences among countries in this indicator are as great as those in Figure 1.1a (and in Figures 1.1b, 1.8 and 1.9 later in this unit), GDP per capita is undoubtedly telling us something about the differences in the availability of goods and services.”

The Economy, Section 1.2

To review: In a first step, GDP per capita is introduced as the stand-in for wellbeing and living standards. In a second step, lest CORE be accused of having a blind spot, the first step is problematised. This problematisation, however, is not meant as the starting point for asking what the measure actually expresses and whether the initial claim holds water. Rather, we are told not to worry because GDP per capita undoubtedly must express something about the differences in the availability of goods and services. Thus, CORE’s way of addressing the question “who can access what wealth” is to side-step it: “whoever can access it, there certainly is a lot to be accessed by someone”. CORE follows its discussion of the ambiguity of GDP per capita as an expression of living standards with:

“Using these methods, we can use GDP per capita to unambiguously communicate ideas such as ‘people in Japan are on average a lot richer than they were 200 years ago, and a lot richer than the people of India today.’”

The Economy, Section 1.2

Section 1.2 started with asking “but is [the average, CC] the right way to measure their living standards, or wellbeing” and ends with the observation that we can communicate the average unambiguously; well, then.

If CORE were honest about its findings in Section 1.2 it would have to rephrase “Since the 1700s, increases in average living standards became a permanent feature of economic life in many countries” (Unit 1, Introduction) as “Since the 1700s, increases in GDP per capita became a permanent feature of economic life in many countries. This undoubtedly is telling us something about the differences in the availability of goods and services, but it is not quite clear what that means for the wellbeing of people in this society. The gaps between what we mean by wellbeing, and what GDP per capita measures, should make us cautious about the literal use of GDP per capita to measure how well off people are.” But this is perhaps less unambiguous-née-catchy.

At the end of Section 1.2 we are left with an implicit confession that CORE itself draws no specific claim about wellbeing from its own graphs, paired with an explicit resolve to ignore this.

Gross domestic product

However, basing objections to CORE’s boasts about capitalism’s achievements on income distribution means accepting its sleight of hand – the pretence that the provision of people with (or, more commonly, their separation from) the things they need and want in different societies or across one society is captured by:

- reducing all wealth down to one dimension,

- adding up the privately held wealth in society and

- dividing the result by the number of members in society.

Reduction to one dimension

“GDP measures the output of the economy in a given period, such as a year. Diane Coyle, an economist, says it ‘adds up everything from nails to toothbrushes, tractors, shoes, haircuts, management consultancy, street cleaning, yoga teaching, plates, bandages, books, and the millions of other services and products in the economy’.

Adding up these millions of services and products requires finding some measure of how much a yoga class is worth compared to a toothbrush. Economists must first decide what should be included, but also how to give a value to each of these things. In practice, the easiest way to do this is by using their prices.”

The Economy, Section 1.2

CORE acknowledges the oddity of adding up toothbrushes, pigs and computers as the same thing. To write a text a computer is required and no amount of pigs can replace it.

But CORE discusses the problem as one of choice: economists must decide what to include and how to assign a value or a common dimension. CORE apparently does not find anything remarkable about declaring that its figures are products of its own subjective decisions rather than results derived from the object. As far as CORE is concerned, economists might as well add up weights (services get a zero), add up the water used up in production or how yellow things are. All of these choices would – in principle – work for counting stuff in some way. In practice, it is straightforward to estimate how much a thing weighs or how yellow it is.

Of course, these choices are easily recognised as silly. In capitalist economies, the worth of things is measured in money. Our thought experiment served to highlight that counting in money is in no way a mere pragmatic choice that economists make: instead, they, obviously, know what counts as wealth in capitalist societies. They do not choose prices but find them. Prices are not some convenient counting aid chosen by economists, but economic facts that economists need to explain. Somehow, the societies that CORE studies reduce toothbrushes, computers and yoga classes to a common dimension – money – “in practice”.

Unit 1 more asserts than explains its neoclassical view on what a price is. When Unit 1 speaks of “value” and “worth” it does not merely mean the economic categories which are expressed in a price and which have yet to be explained. Instead, following its predecessors, CORE literally means how much people appreciate, like or want something, how good something is: Unit 1 presupposes some abstract notion of utility or pleasure.

This notion is nonsense. Computers are not better or worse as such than pigs either subjectively or objectively. Their respective utility depends on the purpose being pursued, e.g. writing a text, for which pigs are ill-suited.7 Computers and pigs are different and thus satisfy different needs.8

CORE’s theory of utility not only asserts that people prefer sausages over socks but also that this preference is quantified: I like sausages twice as much as socks or, if I like (x) sausages and (y) pairs of socks, then I also like (x + a) sausages and (y - b) pairs of socks, as long as (a) and (b) have the right relative relation; proof: those happen to be the observed exchange relations on the market and the tautological theory of prices is complete:

“For goods and services that people buy we take their price as a rough measure of their value (if you valued the haircut less than its price, you would have just let your hair grow).”

The Economy, Section 1.2

It is a fact well-known to economists that poor people do not value haircuts, decent flats, food, clothing or entertainment as much as rich people, this is why they let their hair grow, live in small, cramped flats, eat junk food and do not go out as much. As absurd as it sounds when said out loud, CORE’s identification of price and pleasure appeals to experience. The reader is invited to think about their day-to-day life where questions like “How much money is a haircut worth to me?” are common. However, when asking this question we already compare the amount of our money with the price of the things we would enjoy doing. We come to the conclusion that these magnitudes – our means and the price we are confronted with – do not match up and hence have to limit ourselves. Only after we have compared the respective magnitudes do we then limit our needs and desires, and make the comparison forced upon us: what can I do without. This way the daily grind appears as if the exchange relations were determined by our own individual needs and desires, or as if prices express preference and pleasure. In other words, despite what CORE appeals to, we are not actually comparing the utility of different goods and then assigning prices, but are merely comparing our means with what is available for them based on the prices we are confronted with.

Addition, no matter what

While economists find prices in capitalist societies, they are not the convenient counting aids CORE chooses to treat them as. CORE notices this when it realises that not everything has a price. It knows of the fallacy of measuring things in prices which do not have one and mentions it when criticising disposable income as a measure of wellbeing:

“For example, disposable income leaves out: The quality of our social and physical environment such as friendships and clean air. Goods and services that we do not buy, such as healthcare and education if they are provided by a government. Goods and services that are produced within the household, such as meals or childcare (predominantly provided by women).”

The Economy, Section 1.2

Yet CORE is silent on the question of how the GDP measures goods and services that are never bought and sold, or hugs. On the other hand, CORE has a solution for valuing the actions of the state – the haircut quote above continues:

“But the goods and services produced by government are typically not sold, and the only measure of their value to us is how much it cost to produce them.”

The Economy, Section 1.2

CORE chooses to value state actions by precisely the magnitude – cost – it excludes when valuing everything else:

“Production: The total produced by the industries that operate in the home economy. Production is measured by the value added by each industry: this means that the cost of goods and services used as inputs to production is subtracted from the value of output. These inputs will be measured in the value added of other industries, which prevents double-counting when measuring production in the economy as a whole.”9

The Economy, Section 13.3, emphasis in the original

The question of what is to be measured – what it means to be part of the overall economic output – is replaced by a valuation method, with the mere appeal of being feasible: all items to be counted are selected and redefined for this purpose.

Prices fail to live up to CORE’s expectations as convenient counting aids in a second way: they keep changing, because they are the means by which different economic actors compete against each other. This is why CORE does not actually use the prices found “in practice” in a given society at a given point in time to compose its figures. In an “Einstein” section, CORE explains how the GDP is calculated and compared between different countries and times. The calculation starts by choosing a reference year and economy, e.g. 1990 in the UK. Then, the prices of all products and services produced that year are added up to calculate the GDP. For example, if a society produced 100 bottles of milk (£1 each), 10 tractors (£10k each), 2 nuclear weapons (£10M each) and 5 chickens (£10 each) that year, the GDP would be (100 \times £1 + 10 \times £10k + 2 \times £10M + 5 \times £10). Now, to compare this GDP with the GDP from 1450, economists estimate what products were produced that year. Let’s say: 10 bottles of milk, no tractors but 1 horse plough, zero nuclear weapons, 15 chickens and 5 bibles. These products are then added up using the 1990 GBP prices, where the prices for products that are no longer in production in 1990 Britain are somehow estimated. Comparisons between different countries proceed analogously: estimate how much of each thing was produced and add up these things using their 1990 GBP prices.

As before, while the method of adding up and comparing is feasible, CORE does not explain what can be learned from expressing and comparing the economic output of China in 1500AD with the output of India in 1750AD using 1990 USD prices.

Dividing the pie

It is peculiar that CORE and other economists add up the product of self-sufficient respectively private producers and proprietors as one social product, despite the fact and celebration that these products are very much not at the collective disposal of society. Joining in with CORE’s trip down history lane, why would a peasant in 1400 AD Britain be in the slightest bit interested in the production of a crop by some other peasant at the other end of the British Isles? Or why, for that matter, would it make sense to add up his crop and the castle their lord built as one gross domestic product? If anything, that castle represents a deduction from the peasant’s wealth or free time, as its production is premised on the peasant’s exploitation.

In modern times, how does it make sense to add up as one collective product the cars of one manufacturer, produced with the intent and effect of bankrupting their competitors, with the cars produced by those they bankrupted? How does it make sense to add up the management consultancy suggesting firing a bunch of workers with the products those workers produced before they got fired as one collective win for capitalism in the UK? In all these cases, the amounts added up belong to their respective, competing owners.

An analogy: when two states wage war against each other, they maintain military hospitals to tend to the wounds of their respective soldiers inflicted by the soldiers of the other side. These hospitals exist with the expressed purpose of breaking the power of the competing state by returning soldiers to the battlefield where their mission is to send the enemy’s soldiers to a hospital or morgue. Certainly, these hospitals are not available for tending to the enemy. Moreover, the better one of the two parties is at patching up its wounded soldiers, the more precarious the situation becomes for the other. Just because there are two numbers with the same unit does not mean it makes sense to add them up: It would be absurd to add up and celebrate the hospitals of these two warring states as humanity’s total sum of healing facilities. Unless you have the power to disregard the purpose for which these hospitals exist, that is.

Returning to private wealth, this power exists in the form of the capitalist state. No one bats an eye when CORE whips out its GDP sums because those kinds of calculations are anything but unworldly. Capitalist states commission GDP statistics on an annual basis, gauging the success of the economies they rule over. Thus, they express that from their standpoint, the wealth held in private hands in their respective societies indeed constitutes one social wealth that they can dispose over as the holders of the monopoly on force. Capitalist states partake in the success of their private economies, deciding on and collecting taxes. The better their economies thrive the better they can pursue their projects, such as looking after their economies, strong-arming other states into some favourable deal, etc. As such, the wealth accumulated in private hands determines the freedoms and limits of a state’s rule.

That is to say, from the standpoint of the capitalist state, adding up the privately held wealth as if it were one wealth – its own – makes sense. This added up wealth, though, is not what economists count as the GDP, as the actions of the state itself are included in the GDP. Furthermore, the fact that the state can add up the private wealth in society does not imply it is an operative economic category. Just as the average marks of a class of pupils may be a metric for their performance in some test, this benchmark score itself does not say anything about why students did well or poorly in this test. Indeed, capitalist states engage with their economies not by abstractly measuring GDP but by tending to the specific needs they identify for boosting economic growth: change a regulation here, tweak a tax, provide some subsidies there etc.

When capitalist states add up the wealth under their rule as one wealth, they do not intend to expropriate this wealth in its entirety. They appreciate wealth in private hands as the economic foundation of their rule. Even more, capitalist states know that partaking in the success of capitalist economies is also to the detriment of these economies: every penny expropriated is a penny that cannot be reinvested. Thus, capitalist states turn to debt. To assess their creditworthiness, creditors routinely apply the debt to GDP ratio. While this measure is about as scientific as the GDP on which it is based, it is nonetheless used (until it isn’t) as a standard.10 Consequently, GDP develops from a funny idea of economists into an economic datum to be reckoned with. In a modern capitalist economy, everything depends on credit, and credit decisions are routinely made taking the GDP into account.

CORE’s intended learning outcome in Unit 1 is nationalism: the identification of personal wellbeing with the success of the nation and state. CORE first adds up the wealth in separate, competing hands as one wealth and then divides that sum by the members of society because it wants to think of the wealth that its students and most people are excluded from as our wealth: marvel at the success of our economy in the hands of others.11 When my competitor drives me into bankruptcy and uses their new position on the market to extend production, my average living standard rose. When my boss changes production, fires me and uses new machines to extend production, my average living standard rose. This pretends that the private wealth in society is a social good while affirming that it is in private hands. That is, CORE pretends that private property does not exist in its arithmetic to celebrate its successes. To square this circle, CORE appeals to potential or availability. The wealth of society is potentially ripe for the taking, something that each of us could, in principle, acquire if we apply ourselves – the meritocracy says “hi”. In the world of CORE, that accumulated wealth I am excluded from represents an earning potential. CORE’s response to those who point to the actual poverty in modern capitalist societies is that there is a lot of potential wealth in the hands of others to be competed for.

Much wealth

CORE asks:

“How can we explain the change from a world in which living conditions fluctuated if there was an epidemic or a war, to a situation in which most of the time each generation is noticeably, and predictably, better off than the previous one?”12

The Economy, Section 1.6

and explains:

“An important part of our answer will be what we call the capitalist revolution: the emergence in the eighteenth century and eventual global spread of a way of organizing the economy that we now call capitalism.”

The Economy, Section 1.6

CORE then “precisely defines” capitalism as

“[a]n economic system in which private property13, markets14, and firms play an important role.”

The Economy, Section 1.6

However, soon after, CORE realises that “playing an important role” is perhaps a bit thin for a definition15 and more narrowly considers the firm as the characterising feature of capitalism:

“But private property and markets alone do not define capitalism. In many places they were important institutions long before capitalism. The most recent of the three components making up the capitalist economy is the firm.”

The Economy, Section 1.6

CORE gives this definition:

“A firm is a way of organizing production with the following characteristics:

- One or more individuals own a set of capital goods that are used in production.

- They pay wages and salaries to employees.

- They direct the employees (through the managers they also employ) in the production of goods and services.

- The goods and services are the property of the owners.

- The owners sell the goods and services on markets with the intention of making a profit.”

The Economy, Section 1.6

CORE, firstly, knows that the members of a capitalist economy are split into two classes insofar as production is concerned – those who own capital or firms and those who work for one – and recognises this as a particularity of the capitalist mode of production:

“Firms existed, playing a minor role, in many economies long before they became the predominant organizations for the production of goods and services, as in a capitalist economy. The expanded role of firms created a boom in another kind of market that had played a limited role in earlier economic systems: the labour market.16 Firm owners (or their managers) offer jobs at wages or salaries that are high enough to attract people who are looking for work.”

The Economy, Section 1.6

CORE, secondly, knows of the driving motive for production in capitalist societies: profit. Not the mere provision of people with what they need and want but a principled more, a surplus counted in money over what was advanced is to be realised. While no actual economic actor pursues the aim of maximising GDP – CORE’s mission assigned to the economy – firms do pursue the aim of maximising their own wealth, a fact which CORE celebrates in its first unit by adding up the successes of these shenanigans as one big win for us all.

CORE then asks:

“How could capitalism lead to growth in living standards?”

The Economy, Section 1.7

and answers: specialisation and technology.

Specialisation

“The growth of firms employing large numbers of workers – and the expansion of markets linking the entire world in a process of exchange – allowed historically unprecedented specialization in the tasks and products on which people worked. In [Section 1.8, CC], we will see how this specialization can raise labour productivity and living standards.“

The Economy, Section 1.7

CORE’s explanation of specialisation from marketisation starts with:

“When you hear the word ‘market’ what word do you think of? ‘Competition’ probably is what came to mind. And you would be right to associate the two words.

But you might have also come up with ‘cooperation’. [We totally didn’t, CC] Why? Because markets allow each of us pursuing our private objectives to work together, producing and distributing goods and services in a way that, while far from perfect, is in many cases better than the alternatives.”

The Economy, Section 1.8

Observing that this society organises the production and distribution of goods in the form of competition, CORE invites the reader to only keep in mind that there is production and distribution going on. CORE illustrates the benefits of the market with an example which introduces us to Carlos and Greta. They have different resources when it comes to producing apples and wheat. In such a situation, we would say that it makes sense for the two of them to have a little chat about how many apples and wheat they want/need, how to best organise their production, how to make use of the resources available to them, whether they want to specialise and how etc.

Yet this straightforward approach to the production of apples and wheat is not what Carlos and Greta engage in as we meet them in Unit 1. The reason is that CORE imagines them as private proprietors as they frequent the market in order to play a game of “what if there was no market”. The two forms of division of labour that exist for CORE are “no division of labour” and a market. From this premise CORE derives that some form of division of labour is better than none and this, somehow, ought to be taken as an advantage of the specific form of division of labour under consideration here.17

CORE’s example does not justify the praise. Here, Carlos happens to be the proprietor of less fertile land than Greta who happens to have a legal title to a more fertile piece of land. Thus, Carlos has to make do with whatever resources he happens to have a legal right to. Under these restrictions of the regime of private property where Carlos is excluded from Alice’s land and vice versa, CORE suggests the production of apples to Carlos, because his land is relatively less bad for the production of apples than wheat. That is, CORE suggests a way of working with the restrictions imposed by private property. Nothing in CORE’s example engages with the constraints imposed by the labour process itself to achieve the best outcome but instead it deals with the effects of the very regime that it intended to promote. Somehow, this ought to convince the reader that a mode of production, where you may or may not happen to have a legal right to the adequate means of production and where you must make do regardless, is “a way of connecting people” “in many cases better than the alternatives”.

On the other hand, CORE also knows “a way of connecting people” that deserves the same praise as the freedom of the market, namely its opposite: command in a firm.

“So when the owner of a firm interacts with an employee, he or she is ‘the boss’.

The Economy, Section 1.7

CORE is not quite happy, though, with what it, following Adam Smith, has arrived at here for a firm and suggests to simply pretend that what it described is the opposite:

“This description of the firm stresses its hierarchical nature from top to bottom. But you can also think of the firm as a means by which large numbers of people, each with distinct skills and capacities, contribute to a common outcome, the product [they somehow forgot to add ‘which the owners sell on markets with the intention of making a profit’, CC]. The firm thus facilitates a kind of cooperation among specialized producers that increases productivity.”

The Economy, Section 1.8

While we are at it, you can also think of firms as a means for organising Christmas parties and, by the same logic, a slave driver as facilitating “a kind of cooperation […] among producers that increases productivity”.

The sleight of hand here is the same as above: from the fact that in this economy production is organised under the command of capitalist firms and their agents, the reader is invited to keep in mind only that there is some sort of production going on. CORE’s praise for the particular institutions of capitalism proceeds by ignoring their specific nature and praising a truism: this division of labour – markets – in society is a good division of labour because it is a division of labour, that other division of labour in a factory – command – is a good division of labour because it is a division of labour.

What is even better than one form of division of labour? An unusual mix of two forms of divisions of labour! The “boss” quote above continues:

“But when the same owner interacts with a potential customer he or she is simply another person trying to make a sale, in competition with other firms. It is this unusual combination of competition among firms, and concentration of power and cooperation within them, that accounts for capitalism’s success as an economic system.”18

The Economy, Section 1.7

We may wonder why this particular mix accounts for capitalism’s success, but CORE’s explanation is as circular as the rest of its theory: capitalism is successful and we observe this mix.

Technology

“As we have seen, the permanent technological revolution coincided with the transition to firms as the predominant means of organizing production. This does not mean that firms necessarily caused technological change. But firms competing with each other in markets had strong incentives to adopt and develop new and more productive technologies,19 and to invest in capital goods that would have been beyond the reach of small-scale family enterprises.20”

The Economy, Section 1.7

In The Economy there is no distinction between productive and unproductive labour or any of that Marxist stuff,21 but somehow the authors know that people make all that wealth which is counted in money, and they do this by turning previously produced capital goods – machines, raw materials, etc. – into more products which are then sold for more money than was advanced for their production.

For CORE, though, the relationship between technology and people is somewhat inverted. On technology, CORE explained in an earlier Section:

“In everyday usage, ‘technology’ refers to machinery, equipment and devices developed using scientific knowledge. In economics, technology is a process that takes a set of materials and other inputs – including the work of people and machines – and creates an output. For example, a technology for making a cake can be described by the recipe that specifies the combination of inputs (ingredients such as flour, and labour activities such as stirring) needed to create the output (the cake). Another technology for making cakes uses large-scale machinery, ingredients and labour (machine operators).”

The Economy, Section 1.4

Thus, we learn that cake making takes the work of people as input and it produces an output. The subject of the labour process is a technology, the actual subjects of this process – the people doing it – are its inputs or objects. On the one hand, this is upside down, technology never takes labour as an input: people in their process of production make use of technology. On the other hand, it is not surprising that disciples of the capitalist mode of production characterise the relationship between technology and workers this way. Workers on a modern factory floor are not the subjects of the process of production they are engaged in. Instead, their firm’s owners decide on what ought to be produced, how and with what intensity. The firm’s owners are the subject of production and indeed apply workers and machines as they see fit. They design that process to ensure that workers do what they want of them, applying and designing technology with this purpose in mind. That is, their purpose of profit making is programmed into the technology that confronts their workers.22 Workers are human resources as CORE highlights in a comparison with those “small-scale family enterprises”:

“Contrast this [a firm, CC] with a successful family farm. The family will be better off than its neighbours; but unless it turns the family farm into a firm, and employs other people to work on it, expansion will be limited. If, instead, the family is not very good at farming, then it will simply be less well off than its neighbours. The family head cannot dismiss the children as a firm might get rid of unproductive workers.23 As long as the family can feed itself there is no equivalent mechanism to a firm’s failure that will automatically put it out of business.”

The Economy, Section 1.6

CORE is not coy about the role of workers in a capitalist firm: they eat if and only if the performance that their wage pays for contributes to a firm’s profit. With its celebration of hiring and firing workers and their application by technology, CORE implicitly addresses the core of the matter that explains the wealth growth that it set out to explain: squeezing more work out of workers than is required for their own reproduction.

Little cake, much work

At the beginning of Unit 1, CORE identifies the total social product and total social income.24 GDP measures how much stuff is produced in a given time. Insofar as income ought to represent living standards, it must express what is available for consumption, products to be enjoyed.25 However, part of the annual product has to be used to replace capital goods so that machines, raw materials etc. are again available in the next year. These goods are not for anyone’s consumption, they simply replace the goods used up in production. For example, let us return to Grete producing wheat and let us assume 10% of all wheat needs to be sown again to produce wheat next year. Then, 10% of the annual product of wheat are not available for individual consumption, but need to be retained in production.26

Now, if Grete follows CORE’s advise to maximise production and expands her wheat production, more of this year’s wheat needs to be set aside for becoming seeds. Since GDP in the form of capital goods is a central premise for future GDP growth, making many things which can be used next year to make even more things ought to be prioritised over making things which are consumed unproductively; machines not Xboxes. Put differently, as a society, simply eating up your GDP sins against the objective of maximising it. The demand for GDP growth is a demand against the members of society to consume little. Thus, when firms pursue growth through profits and optimise the wage for this purpose,27 they realise the objective of maximising GDP. Insofar as wages can be reduced without negatively affecting outputs, low wages are demanded from the standpoint of maximising GDP. Workers will merely consume their wages, profits can be reinvested to make even more profits, i.e. “living standard”.28 A society which aims to maximise the GDP strives to waste as little wheat as possible for such unproductive goods as cake. Instead, it maximises the percentage of wheat it sows out again each year to produce even more wheat.

According to the logic of maximising GDP, if someone in a society figures out how to make nuclear weapons or underpants faster and then uses this productivity increase to make more of underpants to wear themselves or nuclear weapons to drop on others, “living standards” rise. If they simply use this productivity increase to get Friday afternoon off, living standards do not rise. If the members of a society all work additional night shifts for those nuclear weapons – you know, for the fatherland – living standards would rise, too. In order to maximise the GDP, the members of society must be applied by technology, i.e. work, a lot. Working longer produces more and, hence, from the standpoint of maximising GDP working long hours is demanded.29 Increases in productivity, i.e. employing labour saving technologies, do not alleviate this demand: from the standpoint of maximising output, being able to produce more per hour does not imply less hours but the same hours which now simply produce more output.30

A society with the purpose of maximising GDP, i.e. the kind of society CORE advocates for, positions itself in opposition towards the mere consumption and free time of its workers. The more they work and the less they consume the better for the growth of the GDP.

Thus, when CORE concludes:

“We have seen that the institutions associated with capitalism have the potential to make people better off, through opportunities for both specialization and the introduction of new technologies, and that the permanent technological revolution coincided with the emergence of capitalism.”

The Economy, Section 1.9

This should read: the advent of capitalism allowed firms to accumulate wealth at an unprecedented rate and in their pursuit of profit they use technology to squeeze more work out of their workers. Great stuff.

The travails of capitalism

CORE finishes Unit 1 with:

“Countries differ in the effectiveness of their institutions and government policy: not all capitalist economies have experienced sustained growth [gasp!, CC]. Today, there are huge income inequalities between countries, and between the richest and poorest within countries. And the rise in production has been accompanied by depletion of natural resources and environmental damage, including climate change.”

The Economy, Section 1.12

The Economy is a critical textbook and does not fail to mention that there are problems: poverty and the depletion of resources.31 These, however, are not considered as results of private property, markets and firms and the economic laws they imply but express a lack of “effectiveness” of “institutions and government policy”. Instead of investigating its object as what it is, it is neatly divided into its nice, essential and naughty, accidental parts.

With discussing poverty and pollution in this way, CORE manages to pigeon-hole them as secondary problems: they never pose any real questions to the capitalist mode of production, its beauty is presupposed from the beginning and where it is not, the object is redefined until it is. As far as CORE is concerned, capitalism is great, GDP measures living standard and when the reality of this mode of production rears its head: there lies a policy challenge.

Thus, at the end of Unit 1, CORE makes good on its promise to deal with capitalism’s image problem in economics teaching. Everyone involved – teachers and students – can feel content and critical at the same time: “Capitalism is rather good, but there are also many challenges.”

CORE considers previous economics textbooks to be insufficient, fearing that students will find these expositions of capitalism absurd in light of their negative experiences. CORE does not address this with new arguments or ideas – all of those gathered in Unit 1 can also be found in the previous textbooks CORE wants to stand out from. CORE simply pulls certain considerations, which come later in other textbooks, into its first unit. The reason is that CORE considers these thoughts to be useful in directly and clearly communicating: “yes, there are problems, but capitalism is actually incredibly effective and good”. Previous textbooks have tried this with the theorem of insatiability.32 CORE is now choosing GDP. That is all there is to this new approach.

Hence, those who read The Economy lured by its promise of an economics textbook committed to the “experience of real life“ will be disappointed: it does not avoid the mistakes of previous textbooks and thus does not given an adequate account of the capitalist mode of production.

-

The CORE Team, The Economy, 2017, https://www.core-econ.org. ↩

-

Bowles, S., Carlin, W. and Stevens, M. (2017). “The Capitalist revolution”. Unit 1 in The CORE Team, The Economy. Available at https://www.core-econ.org/the-economy/book/text/01.html. We learned many of the arguments presented in this text by reading Capital by Karl Marx. Thus, occasionally we throw in a reference to Capital to make this connection explicit. Readers unfamiliar with Capital can simply ignore these footnotes. Page numbers refer to the respective Penguin editions. ↩

-

For a textbook that asks “Why has the subject of economics become detached from our experience of real life?” in its preface, this is a bold move: speaking to classrooms full of people who have reason to believe that they are worse off than their parents due to the financial crisis and its aftermath, CORE talks about the year 1000 AD. ↩

-

Prior to the “capitalist revolution”, almost no one made a living by “producing and selling goods and services”. Even after the “capitalist revolution”, this is still true for most people even in the capitalist centres of the world: most people have to sell their ability to work. For this outrageous Marxist claim we have to look no further than Unit 9: “The labour market functions quite differently from the bread market described in the previous unit because firms cannot purchase the work of employees directly but only hire their time.” ↩

-

While an appeal to equality might make common sense, it deserves critique. When people judge their own situation in comparison with others, they abstract from their actual needs and desires. Simply put, their unhappiness with receiving less can be addressed by given everybody else less too. The proverbial race to the bottom. This way, everybody is worse off, but according to the standard of equality all is well. To lament that your neighbour drives a bigger car will never fix your crappy car. See Benefit envy without benefit available at https://antinational.org/benefit-envy-without-benefit/ ↩

-

For a given purpose different things can be better or worse: for painting a ceiling a ladder is better than a wobbly chair, but the latter will do. ↩

-

“This common element cannot be a geometrical, physical, chemical or other natural property of commodities. Such properties come into consideration only to the extent that they make the commodities useful, i.e. turn them into use-values. But clearly, the exchange relation of commodities is characterized precisely by its abstraction from their use-values. Within the exchange relation, one use-value is worth just as much as another, provided only that it is present in the appropriate quantity. Or, as old Barbon says: ‘One sort of wares are as good as another, if the value be equal. There is no difference or distinction in things of equal value… One hundred pounds worth of lead or iron, is of as great a value as One hundred pounds worth of silver and gold.’ As use-values, commodities differ above all in quality, while as exchange-values they can only differ in quantity, and therefore do not contain an atom of use-value.” – Karl Marx, Capital Vol 1, p.127 ↩

-

This idea was already criticised by Marx in its formulation by Adam Smith, see below. ↩

-

See “Sovereign debt and economic performance” in Sovereign debt and the crisis in the Eurozone available at https://antinational.org/media/sovereign-debt.pdf ↩

-

When Unit 1 divides total social wealth by the members of society, CORE does not attempt to explain how this wealth comes about, i.e. this is not some “labour theory of value” in disguise. The economic content of GDP per capita is exhausted in the pure formalism of the quotient: GDP/capita. The arbitrary nature of this relationship is illustrated not least by the fact that economists also put GDP in relation to machine hours or to the floor space used for economic purposes in order to derive the respective productivity measures. ↩

-

So much for not being “detached from our experience of real life” of a student generation universally agreed to be worse off than the previous. ↩

-

“[Private property] means that you can: enjoy your possessions in a way that you choose; exclude others from their use if you wish; dispose of them by gift or sale to someone else … ; … who becomes their owner” (The Economy, Section 1.6) This account of private property is straight from a “get of my land” wild west fantasy, where self-sufficient farmers tend to their respective lands independently of each other. As far as CORE is concerned, private property protects the enjoyment of possessions, but in modern capitalism no commodity enters this world with the purpose of being enjoyed by its proprietor. Rather, commodities are produced in order to be exchanged against money and private property protects this purpose. In other words, they are produced for the consumption of others under the little condition that those others can pay. Then, when everyone excludes everyone else from their products in order to extract money, it is in no way a personal, idiosyncratic choice to “exclude others from their use if you wish” or to dispose of what you have “by gift or by sale”. Rather, insisting on sale over gift is the strategy implied by these social relations.

CORE pays the compliment to private property that it protects what happens to be yours: “‘The poorest man may in his cottage bid defiance to all the forces of the Crown. It may be frail, its roof may shake; the wind may blow through it; the storms may enter, the rain may enter—but the King of England cannot enter; all his forces dare not cross the threshold of the ruined tenement.’ – William Pitt, 1st Earl of Chatham, speech in the British Parliament (1763).” (The Economy, Section 1.6) If what happens to be yours does not amount to anything worth mentioning, well, tough luck, private property also protects the vast amount of wealth that happens not to be yours … from you. For most people private property means that they cannot enjoy what the need and want as they are excluded from the means of satisfaction and production by others who insist on only disposing of them by sale. Because this is the economic norm in e.g. the UK, the British State, recognising that the economy it rules over does not even provide minimal sustenance to its participants, provides benefits. Where this, too, does not suffice, the occasional food bank deviates from the “by sale” norm and disposes of food “by gift” to the most needy. ↩

-

“Markets are: a way of connecting people who may mutually benefit; by exchanging goods and services; through a process of buying and selling” (The Economy, Section 1.6) Markets are defined as mutually beneficial by mere fact that people decide to exchange: “They are voluntary: Both transfers – by the buyer and the seller – are voluntary because the things being exchanged are private property. So the exchange must be beneficial in the opinion of both parties.” (The Economy, Section 1.6) Paying 50%+ of your wages on rent in London is clearly beneficial to you. Proof: you are living in London, otherwise you’d move to Slough. CORE, the textbook that wants to teach us about the “economics of inequality” has never heard of only bad options to choose from. ↩

-

Other institutions that play an important role are e.g. banks or the welfare state, so did the steam engine and does oil. The list of important things is ever expanding. ↩

-

The actual relationship between labour market and firms is not as one way as CORE claims. The separation of people from their means of production, to turn them into wage labourers, is a prerequisite for capital: “In themselves, money and commodities are no more capital than the means of production and subsistence are. They need to be transformed into capital. But this transformation can itself only take place under particular circumstances, which meet together at this point: the confrontation of, and the contact between, two very different kinds of commodity owners; on the one hand, the owners of money, means of production, means of subsistence, who are eager to valorize the sum of values they have appropriated by buying the labour-power of others; on the other hand, free workers, the sellers of their own labour-power, and therefore the sellers of labour. Free workers, in the double sense that they neither form part of the means of production themselves, as would be the case with slaves, serfs, etc., nor do they own the means of production, as would be the case with self-employed peasant proprietors. The free workers are therefore free from, unencumbered by, any means of production of their own. With the polarization of the commodity-market into these two classes, the fundamental conditions of capitalist production are present. The capital-relation presupposes a complete separation between the workers and the ownership of the conditions for the realization of their labour. As soon as capitalist production stands on its own feet, it not only maintains this separation, but reproduces it on a constantly extending scale. The process, therefore, which creates the capital-relation can be nothing other than the process which divorces the worker from the ownership of the conditions of his own labour; it is a process which operates two transformations, whereby the social means of subsistence and production are turned into capital, and the immediate producers are turned into wage-labourers. So-called primitive accumulation, therefore, is nothing else than the historical process of divorcing the producer from the means of production. It appears as ’primitive’ because it forms the pre-history of capital, and of the mode of production corresponding to capital.” – Karl Marx, Capital Vol 1, p.874 ↩

-

“This division of labour is a necessary condition for commodity production, although the converse does not hold; commodity production is not a necessary condition for the social division of labour. Labour is socially divided in the primitive Indian community, although the products do not thereby become commodities. Or, to take an example nearer home, labour is systematically divided in every factory, but the workers do not bring about this division by exchanging their individual products. Only the products of mutually independent acts of labour, performed in isolation, can confront each other as commodities.” – Karl Marx, Capital Vol 1, p.131, the English translation is a bit off here: “primitive Indian” ought to be translated as “old Indian” and “performed in isolation” should be translated as “private” as in “private property”. ↩

-

“The same bourgeois consciousness which celebrates the division of labour in the workshop, the lifelong annexation of the worker to a partial operation, and his complete subjection to capital, as an organization of labour that increases its productive power, denounces with equal vigour every conscious attempt to control and regulate the process of production socially, as an inroad upon such sacred things as the rights of property, freedom and the self-determining ’genius’ of the individual capitalist. It is very characteristic that the enthusiastic apologists of the factory system have nothing more damning to urge against a general organization of labour in society than that it would turn the whole of society into a factory.” – Karl Marx, Capital Vol 1, p.477 ↩

-

Under capitalism, though, labour saving technology is only employed if it is cheaper than the wage: “The use of machinery for the exclusive purpose of cheapening the product is limited by the requirement that less labour must be expended in producing the machinery than is displaced by the employment of that machinery. For the capitalist, however, there is a further limit on its use. Instead of paying for the labour, he pays only the value of the labour-power employed; the limit to his using a machine is therefore fixed by the difference between the value of the machine and the value of the labour-power replaced by it.” – Karl Marx, Capital Vol 1, p.515 ↩

-

“The battle of competition is fought by the cheapening of commodities. The cheapness of commodities depends, all other circumstances remaining the same, on the productivity of labour, and this depends in turn on the scale of production. Therefore the larger capitals beat the smaller. It will further be remembered that, with the development of the capitalist mode of production, there is an increase in the minimum amount of individual capital necessary to carry on a business under its normal conditions. The smaller capitals, therefore, crowd into spheres of production which large-scale industry has taken control of only sporadically or incompletely. Here competition rages in direct proportion to the number, and in inverse proportion to the magnitude, of the rival capitals. It always ends in the ruin of many small capitalists, whose capitals partly pass into the hands of their conquerors, and partly vanish completely.” – Karl Marx, Capital Vol 1, p.776 ↩

-

Well, implicitly there is: the production of economic textbooks is included in its sums of social wealth, the production of texts criticising these textbooks is not. CORE’s distinction between productive vs unproductive labour is whether something is sold (or is an action of the state) or not. ↩

-

“In handicrafts and manufacture, the worker makes use of a tool; in the factory, the machine makes use of him. There the movements of the instrument of labour proceed from him, here it is the movements of the machine that he must follow. In manufacture the workers are the parts of a living mechanism. In the factory we have a lifeless mechanism which is independent of the workers, who are incorporated into it as its living appendages.” – Karl Marx, Capital Vol 1, p.548 ↩

-

“Yet the concept of productive labour also becomes narrower. Capitalist production is not merely the production of commodities, it is, by its very essence, the production of surplus-value. The worker produces not for himself, but for capital. It is no longer sufficient, therefore, for him simply to produce. He must produce surplus-value. The only worker who is productive is one who produces surplus-value for the capitalist, or in other words contributes towards the self-valorization of capital. If we may take an example from outside the sphere of material production, a schoolmaster is a productive worker when, in addition to belabouring the heads of his pupils, he works himself into the ground to enrich the owner of the school. That the latter has laid out his capital in a teaching factory, instead of a sausage factory, makes no difference to the relation. The concept of a productive worker therefore implies not merely a relation between the activity of work and its useful effect, between the worker and the product of his work, but also a specifically social relation of production, a relation with a historical origin which stamps the worker as capital’s direct means of valorization. To be a productive worker is therefore not a piece of luck, but a misfortune.” – Karl Marx, Capital Vol 1, p.644 ↩

-

As mentioned above, this mistake goes back to Adam Smith: “The whole price or exchangeable value of that annual produce must resolve itself into the same three parts, and be parcelled out among the different inhabitants of the country, either as the wages of their labour, the profits of their stock, or the rent of their land.” (Adam Smith, Book II: On the Nature, Accumulation, and Employment of Stock, Chapter 2) Marx commented: “This is literally all that Adam Smith has to say in support of his astonishing doctrine. His proof consists simply in the repetition of the same assertion. He concedes, by way of example, that the price of corn not only consists of (v+s) [wages + profit, CC], but also of the price of the means of production consumed in the production of corn, i.e. that it consists of a capital value that the farmer did not invest in labour-power. Nevertheless, he says, the prices of all these means of production can themselves be decomposed, just like the price of corn itself, into (v+s). Smith simply forgets to add: as well as into the price of the means of production used up in their own creation. He refers us from one branch of production to another, and from this again to a third. The statement that the entire price of commodities is either ’immediately’ or ’ultimately’ resolvable into (v+s) would only cease to be an empty subterfuge if Smith could demonstrate that the commodity products whose price is immediately resolved into (c) (the price of the means of production consumed) (+ v+s) are finally compensated for by commodity products which entirely replace these ‘consumed means of production’, and which are for their part produced simply by the outlay of variable capital, i.e. capital laid out on labour-power. The price of these latter commodities would then immediately be (v+s). And in this way the price of the former, too, (c+v+s), where (c) stands for the component of constant capital, would be ultimately resolvable into (v+s). […] Smith’s first error, then, is to equate the value of the annual product with the annual value product. The latter is simply the product of the current year’s labour; the former includes, on top of this, all those elements of value that were used in the production of this annual product, but which were produced in the previous year and partly in still earlier years: means of production whose value only re-appears – and which, as far as their value is concerned, have been neither produced nor reproduced by the labour spent during the current year. This confusion enables Adam Smith to juggle away the constant component in the value of the annual product. The confusion is itself based on a further error in his fundamental conception. He does not distinguish the twofold character of labour itself: labour that creates value, by the expenditure of labour-power, and labour that creates objects of use (use-values), as concrete useful labour. The total sum of commodities annually produced, i.e. the total annual product, is the product of the useful labour operating in the current year; it is only by the social application of labour in an intricate system of varieties of useful labour that all these commodities have come into being; it is only in this way that the value of the means of production used up in their production is retained in their total value, and reappears in a new natural form. The total annual product is thus the result of the useful labour expended during the year; but only one part of the value of this product has been created during the year ; this part is the annual value product, which represents the amount of labour actually performed during the year itself.” (Karl Marx, Capital Vol 2, p.450-453) ↩

-

“Income: The sum of all the incomes received, comprising wages, profits, the incomes of the self-employed, and taxes received by the government.” – The Economy, Unit 13. ↩

-

In CORE’s arithmetic of the GDP, this part of the annual product does not appear as it is neither profit, wages, income of self-employed person or tax. ↩

-

The optimal wage is not necessarily the lowest wage, see Does capital always aim to suppress wages? available at https://antinational.org/en/wage-and-profit-rate/ ↩

-

Before some jokester suggests the counter point that high wages stimulate demand which in turn stimulates accumulation: the same holds true for demand created by investments, where it means accumulation on both the buying and the selling side. Secondly, if high wages were the key to successful capitalist accumulation, a minimum wage of £5,000 and up would be in order; the sky is the limit. However, the moderate wage demands by those who put forward such fixes express that they do not really believe in their own argument. See Jobs, Growth, Justice - an alternative that isn’t available at https://antinational.org/en/jobs-growth-justice-an-alternative-that-isnt/ ↩

-

“The prolongation of the working day beyond the point at which the worker would have produced an exact equivalent for the value of his labour-power, and the appropriation of that surplus labour by capital – this is the process which constitutes the production of absolute surplus-value. It forms the general foundation of the capitalist system.” – Karl Marx, Capital Vol 1, p.645 ↩

-

“The shortening of the working day, therefore, is by no means what is aimed at in capitalist production, when labour is economized by increasing its productivity.8 It is only the shortening of the labour-time necessary for the production of a definite quantity of commodities that is aimed at. The fact that the worker, when the productivity of his labour has been increased, produces say ten times as many commodities as before, and thus spends one-tenth as much labour-time on each, by no means prevents him from continuing to work 12 hours as before, nor from producing in those 12 hours 1,200 articles instead of 120. Indeed, his working day may simultaneously be prolonged, so as to make him produce say 1,400 articles in 14 hours.” – Karl Marx, Capital Vol 1, p.437 ↩

-

The Economy dedicates the whole of Section 1.5 to the environmental impact of capitalism: “Through most of their history, humans have regarded natural resources as freely available in unlimited quantities (except for the costs of extracting them). But as production has soared (see Figures 1.1a and 1.1b), so too have the use of our natural resources and degradation of our natural environment. Elements of the ecological system such as air, water, soil, and weather have been altered by humans more radically than ever before.” But, once again, mentioning the “downsides” is not meant as the starting point for discussing why and how “capitalist production […] only develops the techniques and the degree of combination of the social process of production by simultaneously undermining the original sources of all wealth – the soil and the worker.” (Karl Marx, Capital Vol 1, p.638).

In Section 1.5, the effects of capitalism are held against humanity as a whole and the solution is, naturally, more of the same: “But the permanent technological revolution – which brought about dependence on fossil fuels – may also be part of the solution to today’s environmental problems. Look back at Figure 1.3, which showed the productivity of labour in producing light. The vast increases shown over the course of history and especially since the mid-nineteenth century occurred largely because the amount of light produced per unit of heat (for example from a campfire, candle, or light bulb) increased dramatically. In lighting, the permanent technological revolution brought us more light for less heat, which conserved natural resources – from firewood to fossil fuels – used in generating the heat. Advances in technology today may allow greater reliance on wind, solar and other renewable sources of energy.” Thus, Unit 1’s way of addressing climate change is hoping that the next generation of technology in the service of maximising “living standards”-née-accumulation of capital may not destroy the planet while simultaneously suggesting that the maximisation of GDP is bliss. Under this premise the light/heat ratio is irrelevant as any improved efficiency merely translates to the production of more light.

The Economy does not leave the destruction of the planet up to chance and writes “climate change resulting from economic activity is a major threat to future human wellbeing, and it illustrates many of the challenges of designing and implementing appropriate environmental policies.” (Unit 20) and fails to see the indictment about the capitalist mode of production that this sentence is: only the superior force of the state can prevent this economy from destroying the natural environment we all depend on. The effects of capitalism that CORE appreciates are results of private property, markets and firms. The effects of capitalism that CORE does not like so much are humanity’s sins and a question of regulation. ↩

-

This posits that the fundamental problem of economics is the coordination of insatiable desires with scarce resources. ↩